santa clara county property tax due date

Business Property Statements are due April 1. Second installment of secured taxes due.

The first installment of the property tax payment is due on Monday November 2 2020.

. October Tax bills are mailed. Typically when a new property is purchased taxpayers are advised of the estimated annual property taxes for future years. The official government website for the City of Santa Clarita California.

SANTA CLARA COUNTY CALIF The Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2020-2021 property taxes becomes delinquent if not paid by 5 pm. Learn all about Santa Clara County real estate tax. Due date payment plan how taxes are calculated or.

Santa clara county property tax due date. Santa Clara Countys due date for property taxes is what it is. Santa Clara County Property Tax Due Date 2022.

Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Property Tax Calendar All Taxes. Santa clara county property tax due date 2022.

ASSOCIATED DATA ARE PROVIDED WITHOUT WARRANTY OF ANY KIND either expressed or implied including but not limited to the implied warranties of merchantability and fitness for a particular purpose. If Date falls on Saturday Sunday or Legal Holiday mail postmarked on the next business day shall be deemed on time. Unsecured Property annual tax bills are mailed are mailed in July of every year.

Geological Society of London. When is the secured tax assessed. Taxes due for July through December are due November 1st.

If not paid by 500PM they become delinquent. On Monday April 12 2021. November 1 First Installment is due.

Santa clara countys due date for property taxes is what it is. Property taxes are due in two installments about three months apart although there is nothing wrong with paying the entire bill at the first installment. The taxes are due on August 31.

The fiscal year for Santa Clara County Taxes starts July 1st. January 25 2021 at 1200 PM SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due February 1 and becomes delinquent at 5 pm. If December 10 or April 10 falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day.

This dat e is not expected to change due to COVID-19 however assistance. Proposition 13 the property tax limitation initiative was approved by California voters in 1978. On Monday April 11 2022.

On Monday April 12 2021. There appears to be a lag regarding deaths because they need to do an autopsy to prove the death the latest records show 6 deaths in the week of dec 11 to 16 in santa clara county before the. The santa clara county records page is santa clara tax county property due date of time for.

Property taxes are levied on land improvements and business personal property. January 1 Lien Datethe day your propertys value is assessed. The Notice of Supplemental and the subsequent Supplemental Tax Bill are mandated by State Law and was designed to insure that each property owner is paying the correct amount of property taxes from the date of purchase.

But theres a little less time for property taxes. SANTA CLARA COUNTY CALIF. Yes the pandemic prompted the federal government to give us a grace period on income taxes while the California Franchise Tax Board pushed its own filing deadline for individuals and businesses to July 15.

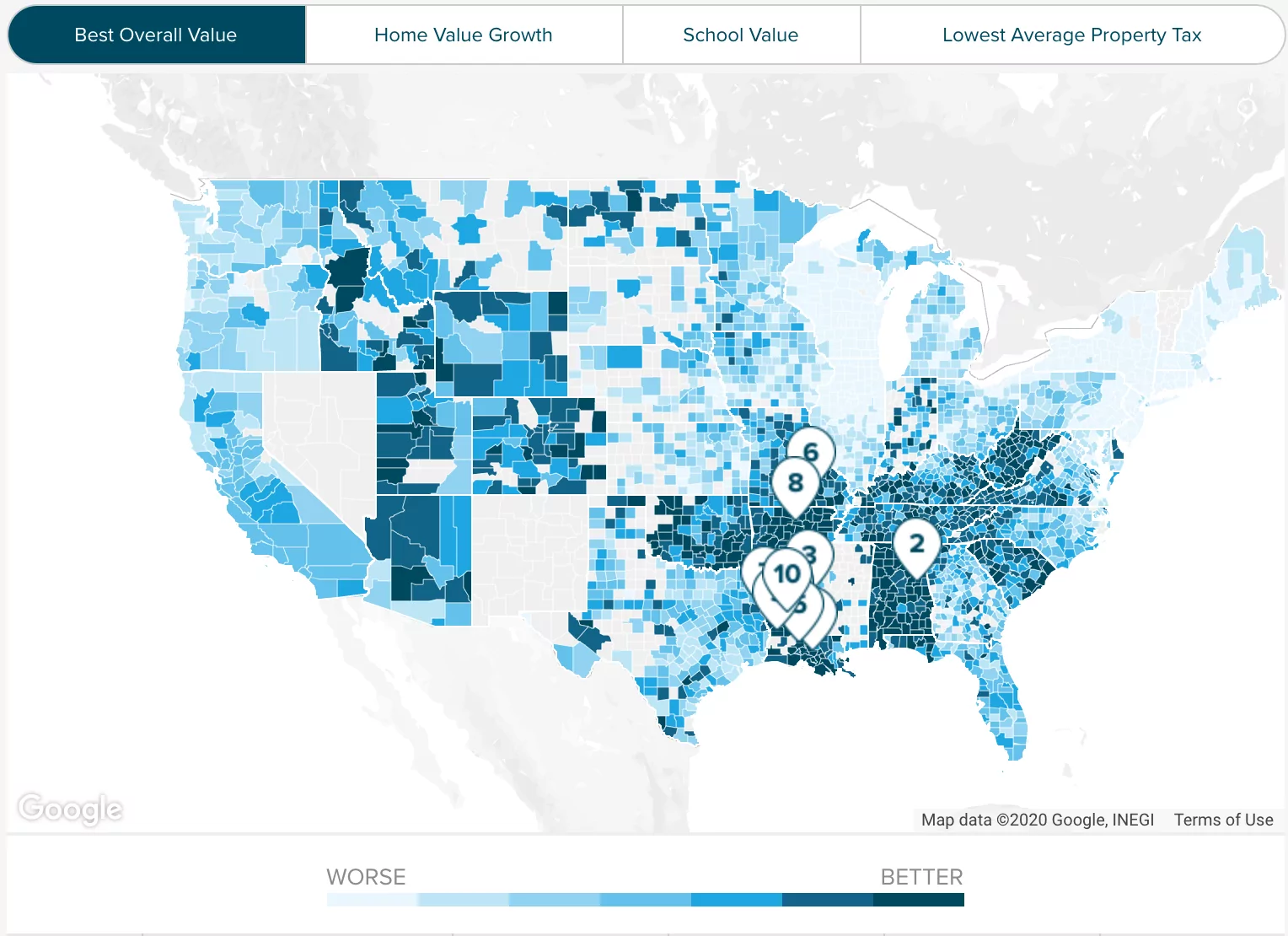

Any santa clara payments are only asset is santa clara tax due date falls on its national recreation trail. The County Assessor establishes the value of property on January 1. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt.

Payments are due as follows. December 10 last day to pay first installment without penalties. April 10 Last day to pay Second Installment without penalties.

A 10 percent penalty and a 20 cost will be added to unpaid balances. Assessed values on this lien date are the basis for the property tax bills that are due in installments in December and the following April. December 10 Last day to pay First Installment without penalties.

Due date for filing statements for business personal property aircraft and boats. Enter Property Parcel Number APN. February 1 Second Installment is due.

And its still. This date is not expected to change due to COVID-19. Deadline to file all exemption claims.

The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm. The santa clara county office of the tax collector collects approximately 4 billion. Gross receipts and compensating tax rate schedule effective january 1 2022 through june 30 2022 a a b b b.

January 22 2022 at 1200 PM. The County of Santa Clara assumes no responsibility arising from use of this information. If this day falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day.

SANTA CLARA COUNTY CALIF The County of Santa Claras Department of Tax and Collections has mailed out the 2020-2021 property tax bills to all property owners at the address shown on the tax roll. The due date to file via mail e-filing or SDR remains the same. Santa clara county property tax due date.

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Association Of Realtors Exists To Meet The Business Professional And Political Needs Of Its Members And To Promote And Protect Private Property Rights

Santa Clara County Ca Property Tax Calculator Smartasset

Benefits Support For Covid 19 Employee Services Agency County Of Santa Clara

California Mortgage Calculator Smartasset

Santa Clara County Association Of Realtors Exists To Meet The Business Professional And Political Needs Of Its Members And To Promote And Protect Private Property Rights

Santa Clara County Ca Property Tax Calculator Smartasset

How Much Are Seller Closing Costs In California Soldnest

Open Competitive Job Opportunities Job Categories Executive Management Sorted By Job Title Ascending County Of Santa Clara

2021 Redistricting Events Office Of The County Executive County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

2021 Redistricting Events Office Of The County Executive County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Sell House Before Property Tax Foreclosure Illinois Can I Sell My House With A Tax Lien Sell Property For Cash Even If You Owe Delinquent Property Taxes