how to find bull flag stocks

Heres how to spot one. Bull flags are fire - I have had.

This happens when the 12-day EMA of the stock moves above the 26-day EMA.

. To trade this strategy on stocks with NSE you need the below setup to identify bull flag pattern while they are still forming. They are pretty rare outside of penny stocks which tend to be less reliable. When I tested scan for bull flag pattern in stocks with average volume above 300K returned only five results as you can see below.

We use this to confirm a bull flag breakout. Finally follow these steps to identify the bull flag pattern. You simply set the screener in Finviz to show stocks that are overbought RSI 60.

Key things to look out for when trading the bull flag pattern are. As the name itself suggests a bull flag is a bullish pattern unlike the bear flag that. The target for a bull flag is derived by measuring the length of the flag pole and projecting it from the breakout point.

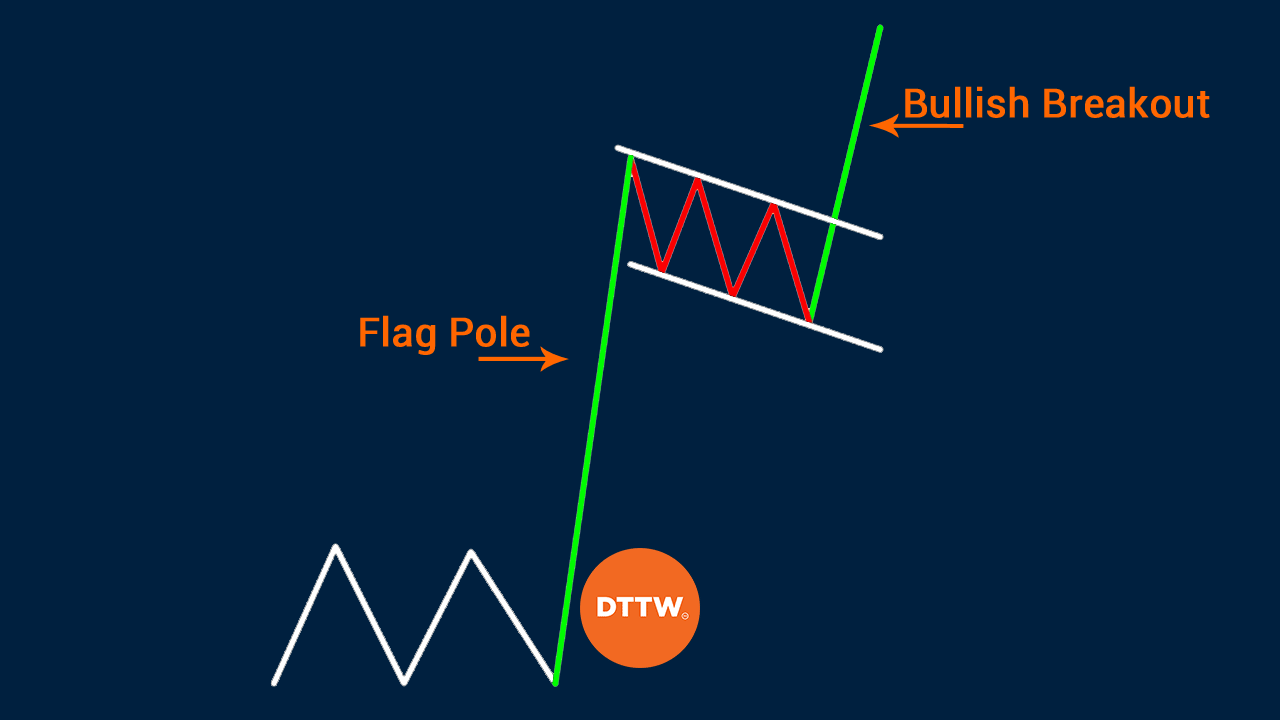

What is the meaning of a Bull Flag Pattern and how does it work. This pattern is named for the resemblance of a flag on a pole. When the lower trendline breaks it.

A bull flag is a continuation chart pattern that signals the market is likely to move higher. When you see the graphical representation of this pattern youll notice that it somehow looks like a flag on a pole. Preceding uptrend flag pole Identify downward sloping consolidation bull flag If.

But today it can be different. Look for a strong trending move higher. MACD Bullish Centerline Cross.

Find a way to trigger into a resolution of price as it begins to move back to the upside. Usually this momentum can be framed under consecutive bars to the upside with very few retracements bars. Jnpatel - hammer stock screener - This screener gives us a hammer formation bearish or bullish.

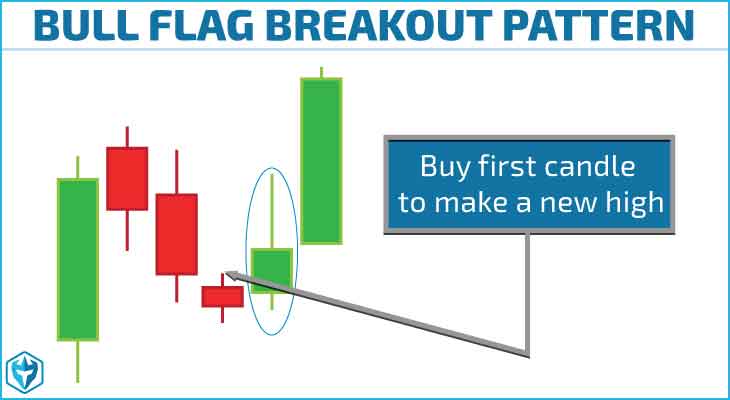

Once price breaks above the last smaller consolidation candle take entry at break of high. Today we talked about screening stocks and finding good bull flag patterns. A bull flag pattern is a bullish continuation pattern used in technical analysis that occurs in a market that is in an uptrend.

Watch for a bullish candlestick that forms a flag pole. A search through the results will usually yield some potential Bull Flag patterns that are forming. Ad Learn why over 350K members have invested over 2 billion with Yieldstreet.

The price action consolidates within the two parallel trend lines in the opposite direction of the uptrend before breaking out and continuing the uptrend. Look for at least 3 or more consolidation candles that hold support levels. What would be the best time frame option for that scan for swing trading.

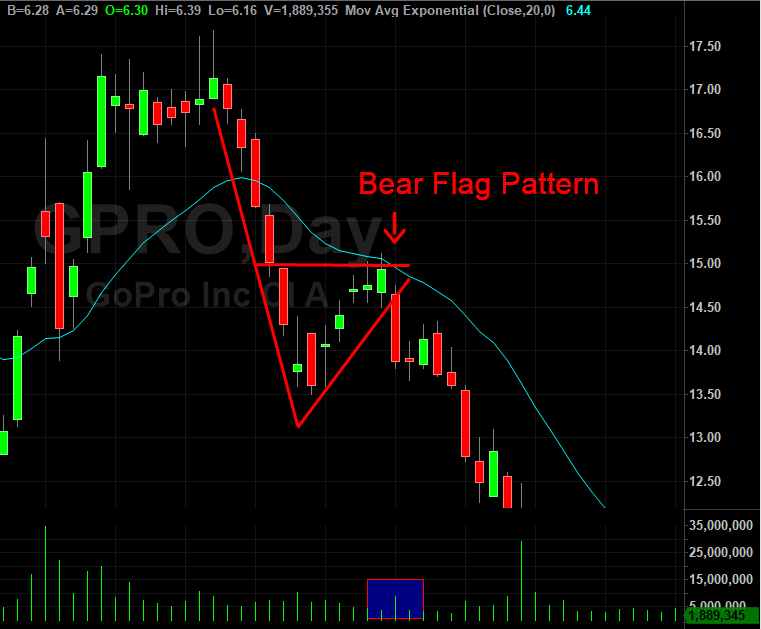

The bear flag is an upside down version of the bull flat. The below BTCUSD 15-minute chart clarifies the details of this formation. Diversify your portfolio by investing in art real estate legal and more asset classes.

Stay tuned for my 3 st. The bull flag is a continuation pattern which only slightly retraces the advance preceding it. You can use other properties to dial it in.

MACD Bearish Signal Line Cross. Its screener has built in predefined function that can find stocks with Flags or Pennants. If a bar breaks above the counter-trendline but closes below it adjust the line to accommodate the break as the pullback continues.

The line will become shallower. This would yield a. I was trying to do 1yr 1day but it doesnt have it.

And the rally needs high volume. Watch if price can break above high of flag pole. Following this step it will also make it visually a little bit easier to plan your next move.

It consists of a strong rally followed by a small pullback and consolidation. A bull flag is a technical continuation pattern which can be observed in stocks with strong uptrends. This happens when the 12-day EMA of the stock moves below the 26-day EMA.

Tradingweekly previous week ve next week may ve - Monthly cci above 100 and uptrendweekly in ve zonedaily in ve or going buy Tulasibuy500 -. Finding Bull Flag patterns is quite easy. The pattern takes shape when the stock retraces by going sideways or by slowly declining after an initial big rise in price.

The bull flag pattern is found within an uptrend in a stock. If the flag portion of the pattern develops a consistent downtrend its often called a bull pennant pattern because the flag has a triangular shape. The flagpole forms on an almost vertical panic price drop as bulls get blindsided from the sellers then a bounce that has parallel upper and lower trendlines which form the flag.

The bull flag is an easy-to-learn pattern that shows a lull of momentum after a big rally. The MACD Line has moved above the zero line to turn positive. It has the same structure as the bull flag but inverted.

The MACD Line has turned down and crossed below the MACD Signal Line. A follow-up rally is likely when combined with other bullish indicators. This means the range of the candles are more bullish than usual and they tend to close near the highs.

Add a new filter for Pattern and you can select FLAG. The price of the stock often surges 15 30 50 even 100 or more out of this pattern. We recommend all the time to play with the charts and zoom out so you can better identify the bullish flag pattern.

Look for an impulse move the pole of the flag in price to the upside during an uptrend. Buy when a candlestick closes above the counter-trendline. In this video youll learn how to identify a bull flag pattern how its used to determine potential buy signals and price targets and the risks and goals.

The bull flag pattern is a continuation chart pattern that facilitates an extension of the uptrend. Identify directional movement to the upside. How to trade bull flag patterns.

Hey everyone what are your thoughts on this type of video. Sample-sobhalin-1212 - Macd daily buy. Zoom out Your Charts and Mark on the Consolidation Zone The Flag of the Bullish Flag Pattern.

How to find stocks that are starting to form a Bull Flag pattern. The technical buy point is when price penetrates the upper trend line of the flag area ideally on volume expansion.

Bull Flag Chart Pattern How To Use In Trading Libertex Com

Bull Flag Chart Pattern Trading Strategies Warrior Trading

What Is Bull Flag Pattern How To Identify Points To Enter Trade Dttw

Bullish Flag Chart Patterns Education Tradingview

Bull Flag Trading 12 Epic Tips Trading Strategies

Bullish Flag Chart Patterns Education Tradingview

Bull Flag Chart Pattern Trading Strategies Warrior Trading

Learn Forex Trading The Bull Flag Pattern

Python Detecting Bull Flag Pattern In Stock Market Data Stack Overflow

Flag Bullish Bearish Chart Pattern By Ktitrading Com Medium

Bull Flag Price Action Trading Strategy Guide 2022

Bull Flag Vs Bear Flag And How To Trade Them Properly

Flag Patterns Bullish And Bearish Accendo Markets

How To Trade Bullish Flag Patterns

How To Trade Bullish Flag Patterns

How To Trade Bull Flag Pattern Six Simple Steps

Bull Flag Chart Pattern Trading Strategies Warrior Trading

:max_bytes(150000):strip_icc()/dotdash_Final_Flag_May_2020-01-337783b3928c40c99752093e6cb03f6d.jpg)