income tax rate philippines 2021

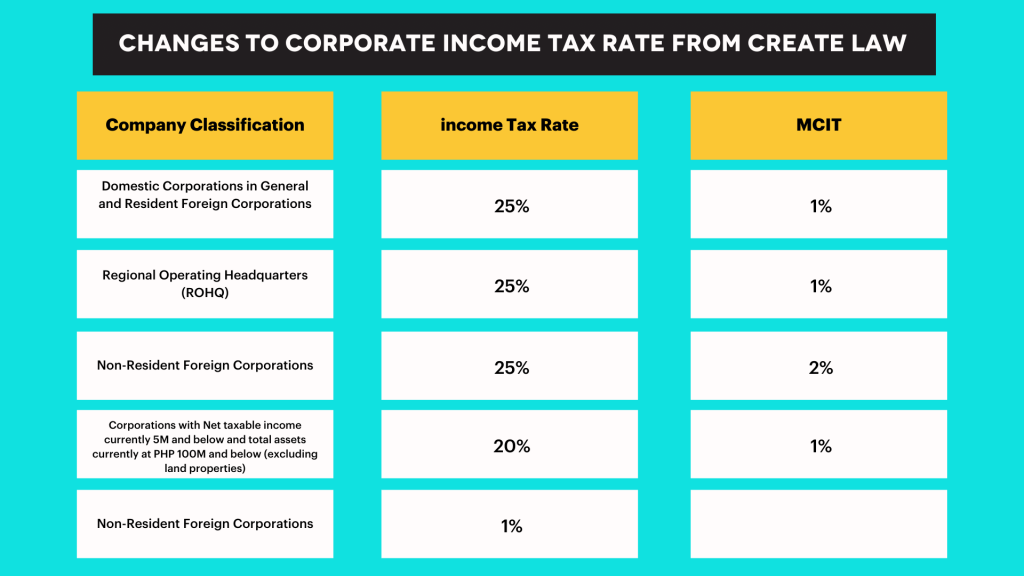

Choose a specific income tax year to see the Philippines income tax rates and personal allowances used in the associated income tax calculator for the same tax year. The CREATE Law reduces the regular corporate income tax CIT of domestic corporations and resident foreign corporations eg branch offices from 30 to 25 effective.

Three Reasons The Philippines Is Not Free Market Capitalist By Joseph J Bautista Medium

The Philippine President signed into law the proposed Corporate Recovery and Tax Incentives for Enterprises CREATE Act on 26 March 2021 1 but vetoed several provisions.

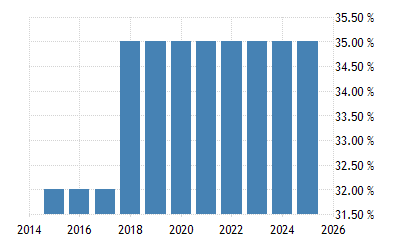

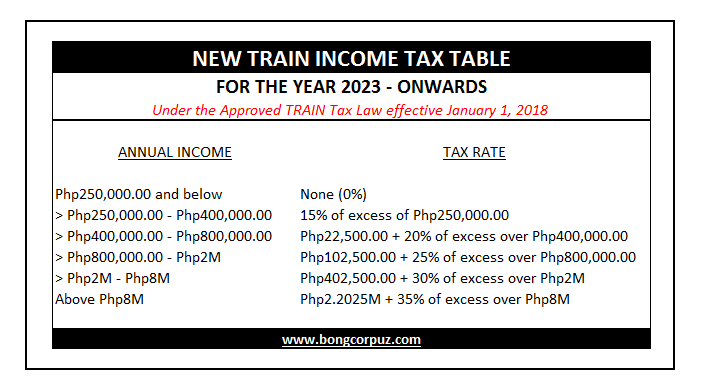

. Personal Income Tax Rate in Philippines remained unchanged at 35 in 2021. Income Tax Rates and Thresholds Annual Tax Rate. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates.

Interest on foreign loans. Philippines Residents Income Tax Tables in 2021. Determine the standard deduction by multiplying the gross income by 40.

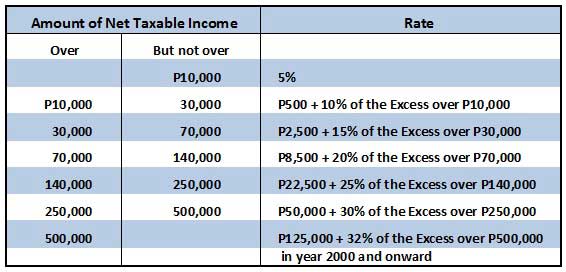

Compliance for corporations. Php 840000 x 040 Php 336000. The maximum rate was 35 and minimum was 32.

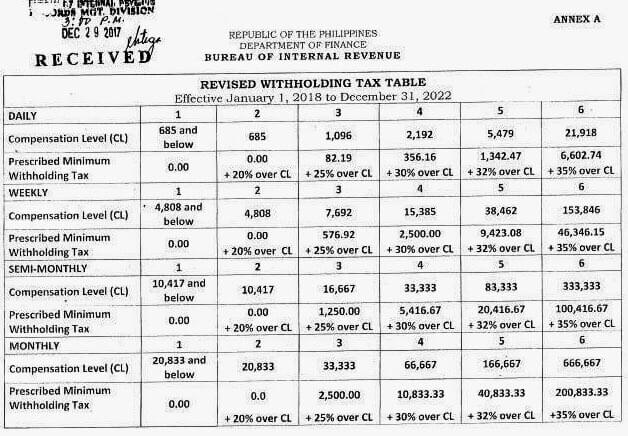

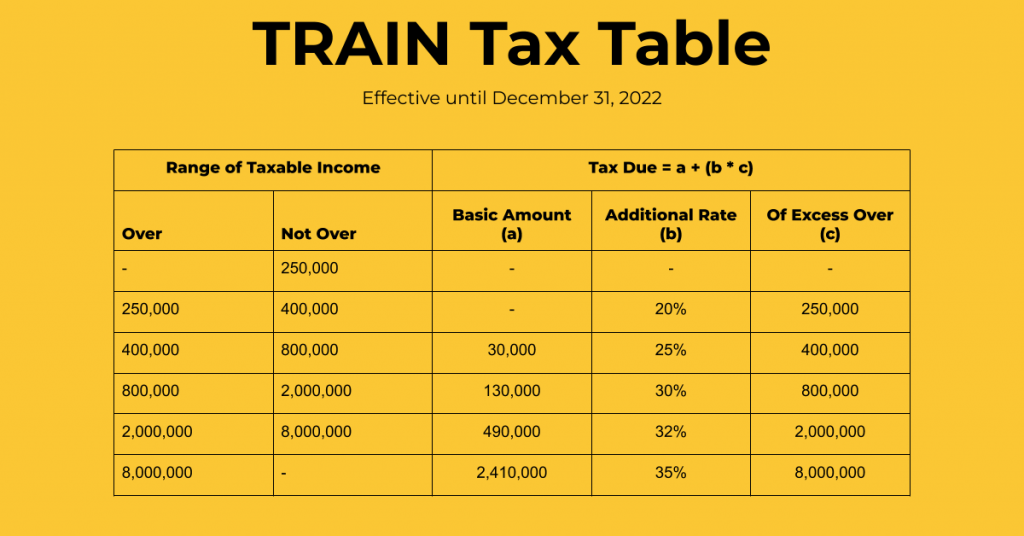

8 Income Tax on Gross SalesReceipts and Other Non-Operating Income in Lieu of the Graduated Income Tax Rates and the Percentage Tax. Tax rate Income tax in general 25. Individual income tax rate Taxable income Rate.

Up to PHP 250000 0 PHP 250001 PHP 400000 20. 8 tax on gross salesreceipts and other non-operating income in excess of PHP 250000 in lieu of the graduated income tax rates and percentage tax business tax or. What is personal tax rate in Philippines.

The Personal Income Tax Rate in Philippines stands at 35 percent. Philippines Highlights 2021. The latest comprehensive information for - Philippines Personal Income Tax Rate - including latest news historical data table charts and more.

Philippines Residents Income Tax Tables in 2024. Income Tax Rates and Thresholds Annual Tax Rate. 11534 Corporate Recovery and Tax Incentives for Enterprises.

Income Tax Based on Graduated. Income Tax Rates and Thresholds Annual Tax Rate. Philippines Residents Income Tax Tables in 2022.

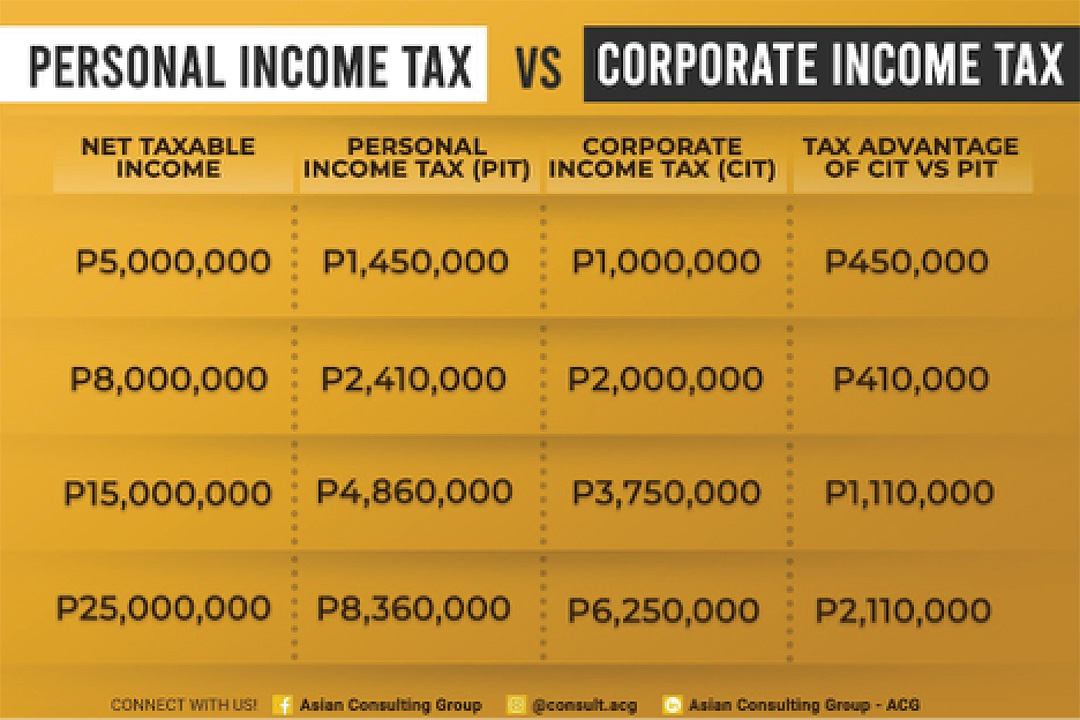

Under CREATE Act the corporate income tax CIT rate for domestic corporations and resident foreign corporations RFCs is 25 and based on taxable income or. The Personal Income Tax Rate in Philippines stands at 35 percent. To get the taxable income subtract the OSD from the gross.

Implements the provisions on Value-Added Tax VAT and Percentage Tax under RA No. Dividends from domestic corporationsif the country in which the. The compensation income tax system in The Philippines is a progressive tax system.

Personal Income Tax Rate in Philippines averaged 3253 percent from 2004 until 2020 reaching an all time high of 35. The Philippine President signed into law the proposed Corporate Recovery and Tax Incentives for Enterprises CREATE Act on 26 March 2021 1 but vetoed several provisions. Personal Income Tax Rate in Philippines averaged 3253 percent from 2004 until 2020 reaching an all time high of 35.

Philippine Tax Calculator Taxumo File Pay Your Taxes Online

Taxing The Rich The Evolution Of America S Marginal Income Tax Rate Infographic

Bir Tax Calculator Factory Sale 57 Off Oldetownecutlery Com

What Is The Difference Between The Statutory And Effective Tax Rate

Czech Republic Personal Income Tax Rate 2022 Data 2023 Forecast

Income Tax Law Under Train Law And New Rates In The Philippines

Guide To American Taxation In The Philippines H R Block

Cryptocurrency Taxation In The Philippines An In Depth Guide

Your First Look At 2021 Tax Rates Projected Brackets Standard Deductions More

Train Tax Tables Income Tax Rates Bong Corpuz Co Cpas

What Are The Income Tax Rates In The Philippines For Individuals Business Tips Philippines

Corporation Or Sole Proprietorship A Tax Perspective Businessworld Online

Us New York Implements New Tax Rates Kpmg Global

Taxes Applicable To Sole Proprietors Freelancers Self Employed And Professionals

Tax Reform In Progress Businessworld Online